Tesla just blinked. After years of Elon Musk insisting that a cheap Tesla was “pointless” and that “the future is autonomous,” the company has launched a stripped-down Model 3 in Germany called the “Standard” for €36,990. That’s a big drop from Tesla’s existing Model 3, now badged the “Premium,” which retails for €45,970.

Despite its German launch and likely European rollout in the New Year, this move is all about China. It is a defensive play aimed at low-priced competition, specifically BYD, whose Atto 3 sells for €37,990 in Germany, and whose Dolphin Surf has landed in the UK at £18,650. Tesla’s European sales have collapsed by over a third this year (excluding Norway, where buyers are panic purchasing before incentives disappear).

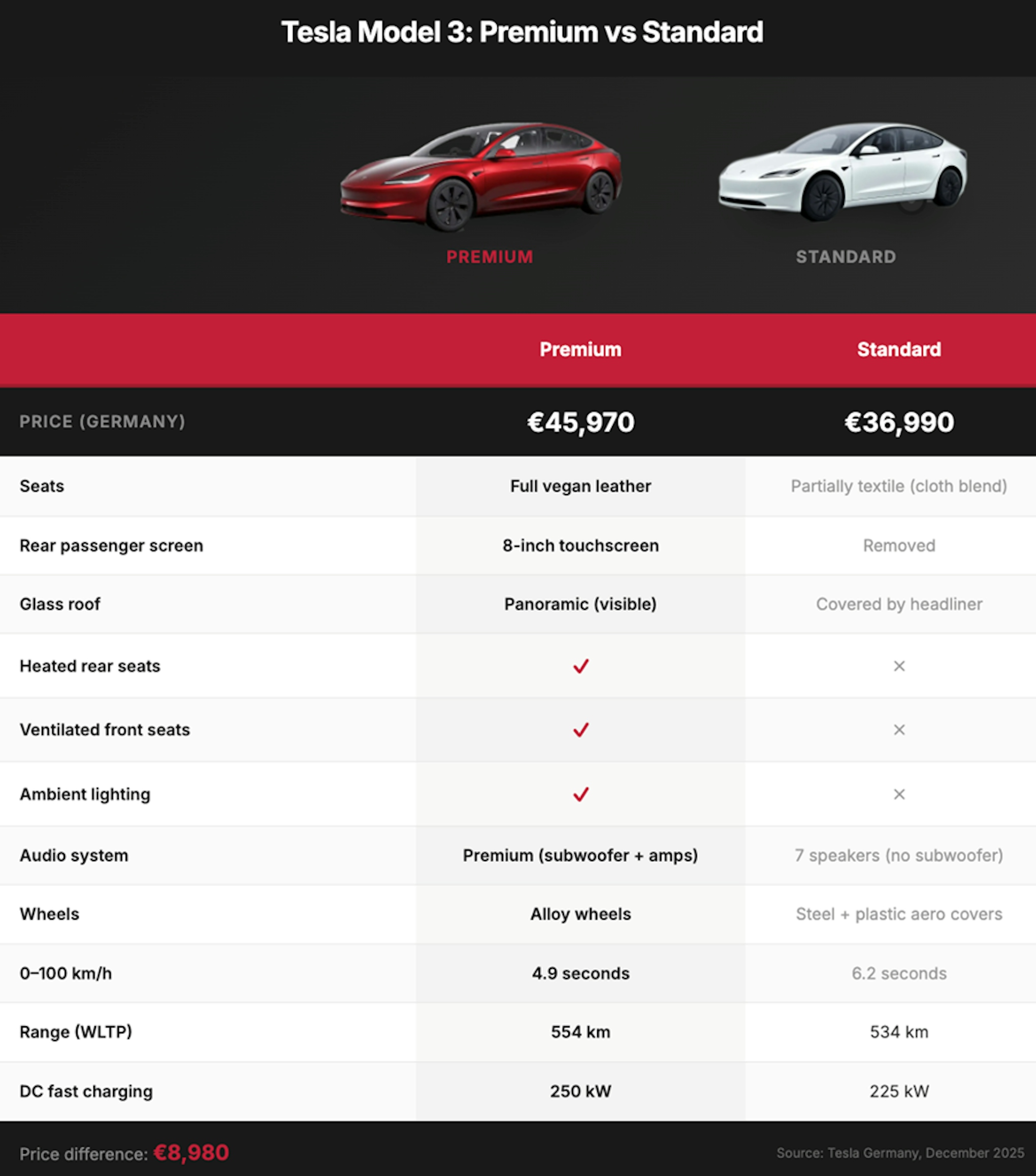

There is no doubt that the Tesla 3 Standard is a step down. And not just in price. The new variant arrives with cloth seats replacing vegan leather, no rear passenger screen, no heated rear seats, a downgraded seven-speaker audio system missing its subwoofer, and steel wheels hidden beneath plastic aero covers. The panoramic glass roof remains, but Tesla has bricked it up with a headliner, sealing occupants off from the sky above like a budget airline blocking out the view.

And then there is the downgraded performance of the new model. The Model 3 Standard has slower acceleration, has a lower range, and is slower to charge. All very odd given the future focus of Tesla’s founder and the fact that the original Model 3 was launched almost a decade ago.

But it all makes sense when you realise that Tesla is launching a “fighter brand”. When your market share is haemorrhaging, and your competitor is undercutting you, there are only a few classic marketing moves available to you. And a fighter brand is one of the most ancient, and risky, responses.

A fighter brand is a very special kind of product because it’s the only one in the marketing playbook that takes its coordinates from competitors rather than consumer needs. Specifically, it is built to take on, and ideally take out, low-priced rivals.

Intel did it with Celeron to combat AMD. Qantas did it with Jetstar to fight Virgin Blue. When it works, a fighter brand is the closest you get to marketing jiu-jitsu: you use your opponent’s momentum against them, sparking innovation and agility, capturing a new value segment and all the while keeping your premium brand above the fray and – if anything – bolstered by the differences it enjoys over its lower-priced sister.

When it works, it’s a win/win of the highest order. The company behind the fighter brand not only nullifies a big threat, but the new product also opens a lower-tier market to add revenue and scale. But the key point about fighter brands is that while the initial brochure looks great, they usually end up being a lose/lose. The company launching the fighter brand not only fails to do anything about their low-priced rival, but also makes their own situation worse.

Most fighter brands fail. Badly. Specifically, there are five key threats to avoid when it comes to launching a fighter brand.

The first hazard is…